Golf is more than a sport in the United Arab Emirates (UAE). It's a way of life, an energy, and a symbol of prestige. With top notch golf courses, enthusiasts from all over the globe flock to the UAE to experience its flawless fairways and staggering greens. However, gaining access to these exclusive courses can sometimes be a challenge.

This is where golf access credit cards step in, offering enthusiastic golf players unmatched comfort and advantages. In this guide, we'll explore the world of golf access credit cards in the UAE, featuring their highlights, advantages, and how they enhance the golfing experience for enthusiasts.

What are Golf Access Credit Cards in the UAE?

Golf access credit cards in the UAE offer eager golf players several perks and benefits tailored to their passion for the sport. These specific credit cards give cardholders admittance to esteemed golf courses across the UAE, along with many advantages intended to upgrade their playing experience. Typically, golf access credit cards offer features such as complimentary rounds of golf at select courses, discounted green fees, priority tee time bookings, and access to exclusive golfing events and tournaments.

Cardholders may likewise get extra advantages, for example, golf equipment discounts, access to golfing clinics or lessons, and personalized concierge services to assist with golf-related reservations and arrangements. These credit cards provide a luxurious and convenient way to access premium golfing experiences while enjoying the financial flexibility of a credit card for enthusiasts who want to elevate their golfing lifestyle. With their tailored benefits and exclusive privileges, golf access credit cards cater to the needs and preferences of golf aficionados in the UAE, enhancing their enjoyment of the game both on and off the course.

Features and Benefits of Credit Cards for Golf Course Access

Credit cards designed for golf course access offer a range of features and benefits designed to enhance the golfing experience for cardholders. Here are some common features and benefits you might find with these credit cards:

Complimentary Golf Rounds

Cardholders might get free extra rounds of golf at selected golf courses, permitting them to enjoy the game without extra charges.

Discounted Green Fees

Many cards offer discounted rates at golf courses, assisting cardholders in getting a good deal on their rounds.

Priority Tee Time Booking

Cardholders may be able to reserve preferred tee times ahead of non-cardholders by using priority tee time bookings.

Access to Exclusive Golf Clubs

Some credit cards give access to exclusive golf clubs that may otherwise be restricted to members only.

Golf Course Rewards

Procure rewards points or cashback on golf-related purchases, such as equipment, apparel, or lessons, when using the credit card.

Best Golf Access Credit Cards In UAE

Some of the best golf access credit cards in the UAE are given below:

ADCB Traveller Credit Card

The primary reasons to choose ADCB Traveller Credit Card are:

20% off on flight & hotel bookings

900 airport lounges worldwide

0% foreign currency transaction fee

Complimentary 2-night stay Hotels.com voucher

Offers available at cleartrip

ADIB Booking.com Infinite Card

The primary reasons to choose ADIB Booking.com Infinite Card are:

200,000 sign-up reward points

Discounts on flight and hotel booking

Exclusive premium travel & lifestyle benefits

Earn rewards & cashback on specific categories

CITI Emirates Ultimate

The primary reasons to choose CITI Emirates Ultimate are:

Earn up to 1.25 Skywards Miles per $ spend

1 free round of golf in a month at the finest courses in UAE

Offers on cinema tickets and valet parking

Unlimited access to 1000+ airport lounges

Emirates Islamic Skywards Infinite Credit Card

The primary reasons to choose Emirates Islamic Skywards Infinite Credit Card are:

Up to 75,000 bonus Skywards Miles

Up to 2 Skywards Miles per USD equivalent spent

Fast-Track update to Emirates Skywards Silver Tier Status

AED 500 noon voucher (T&C's apply)

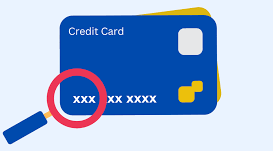

Eligibility Criteria for Credit Cards for Golf Access

Depending on the card issuer and the number of benefits offered, credit cards with golf benefits may have different eligibility requirements. Here are some common eligibility requirements you might encounter:

Minimum Income Requirement: A minimum income is required for many premium credit cards with golf access perks. This guarantees that cardholders will be able to manage the associated costs and fees.

Credit Score: Card guarantors normally expect candidates to have a decent to magnificent credit score to meet all requirements for premium credit cards. A higher credit score demonstrates responsible credit management and reduces the risk for the issuer.

Residency Status: Candidates should be residents of the UAE or hold a legal residency visa to be qualified for certain credit cards. Individuals who are not residents of the UAE or who are on a visit visa may have limited options.

Age Requirement: Candidates should be at least 21 years old to apply for a credit card. A few card issuers might have higher age necessities, particularly for premium cards.

Employment Status: Most credit card issuers expect candidates to have a steady kind of revenue, whether through business, business possession, or different means. Some cards may have specific requirements regarding minimum employment tenure.

Documents Required

While applying for golf access credit cards in the UAE, you will require the following documents:

A valid passport or Emirates ID

Proof of residence which includes recent utility bills (electricity, water, or telephone bills) or a rental agreement in your name.

Proof of income like salary slips, employment letters etc

Recent bank statements

Final Thoughts

As the popularity of golf continues to grow in the UAE, we can hope to see further development in the domain of golf access credit cards. Monetary establishments might introduce new features and advantages to attract clients, for example, partnerships with additional golf courses and resorts, enhanced travel benefits, and personalized experiences tailored to individual preferences. Overall, golf access credit cards have arisen as an important device for energetic golf players in the UAE, this is where My banker comes into play, offering a scope of advantages intended to enhance the golfing experience of its cardholders. From complimentary rounds of golf to exclusive discounts and travel perks, these cards provide unparalleled convenience and luxury for enthusiasts. As the UAE cements its status as a premier destination for golf tourism, golf access credit cards will continue to play a vital role in shaping the future of the sport in the region.